child tax credit 2021 dates canada

If they earned 80000 in 2021 then they would receive 6131 from CCB from July 2022 to June 2023. If you share custody of your children youll get 50 of what youd have received if you had full custody.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Within 8 weeks of our receiving your application online within 11 weeks of sending your application by mail Payments stopped or changed.

. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. Businesses and Self Employed Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. From June 2021 to June 2022 each child eligible for the child disability benefit could receive up to 2915 paid.

For the tax year 2021 youll receive payment from July 2021 to June 2022. Heres the maximum that Canadian families can receive from the CCB as of November 2021. Last updated April 18 2022.

It provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother half-sister or a descendant of one of these for example a grandchild niece or nephew. If you have a child that is eligible for the disability tax credit there is a chance they may also be eligible for the child disability benefit.

The first reduction is at a rate of 135 for income between 32797 and 71060 71060 32797 38263 x 135 5166 clawback. Every page includes a table of contents to help you find the information you need. 6833 per year or 56941 per month for each child under the age of 6 5765 per year or 48041month for each child aged 6 to 17 You can receive an additional 2915 per year if your child qualifies for the Child Disability Benefit.

For more information go to CCBYCS payment dates. To be a qualifying child for the 2021 tax year your dependent generally must. They start with the maximum but then this gets reduced based on their income.

Understand that the credit does not affect their federal benefits. The maximum you can receive is 6833 annually for each child under the age of 6 and up to 5765 for each child between the age of 6 and 17. The CCB young child supplement CCBYCS has a different payment schedule.

First payment You should receive your first payment.

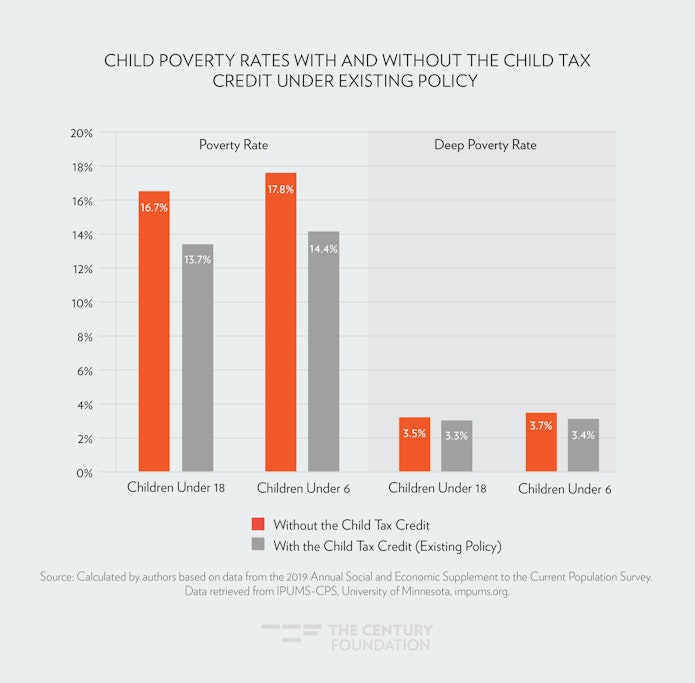

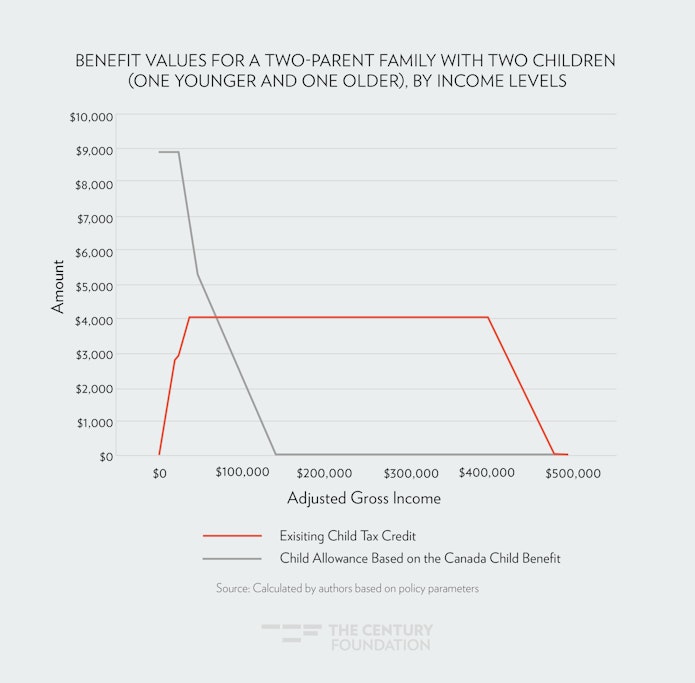

What A Child Allowance Like Canada S Would Do For Child Poverty In America

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

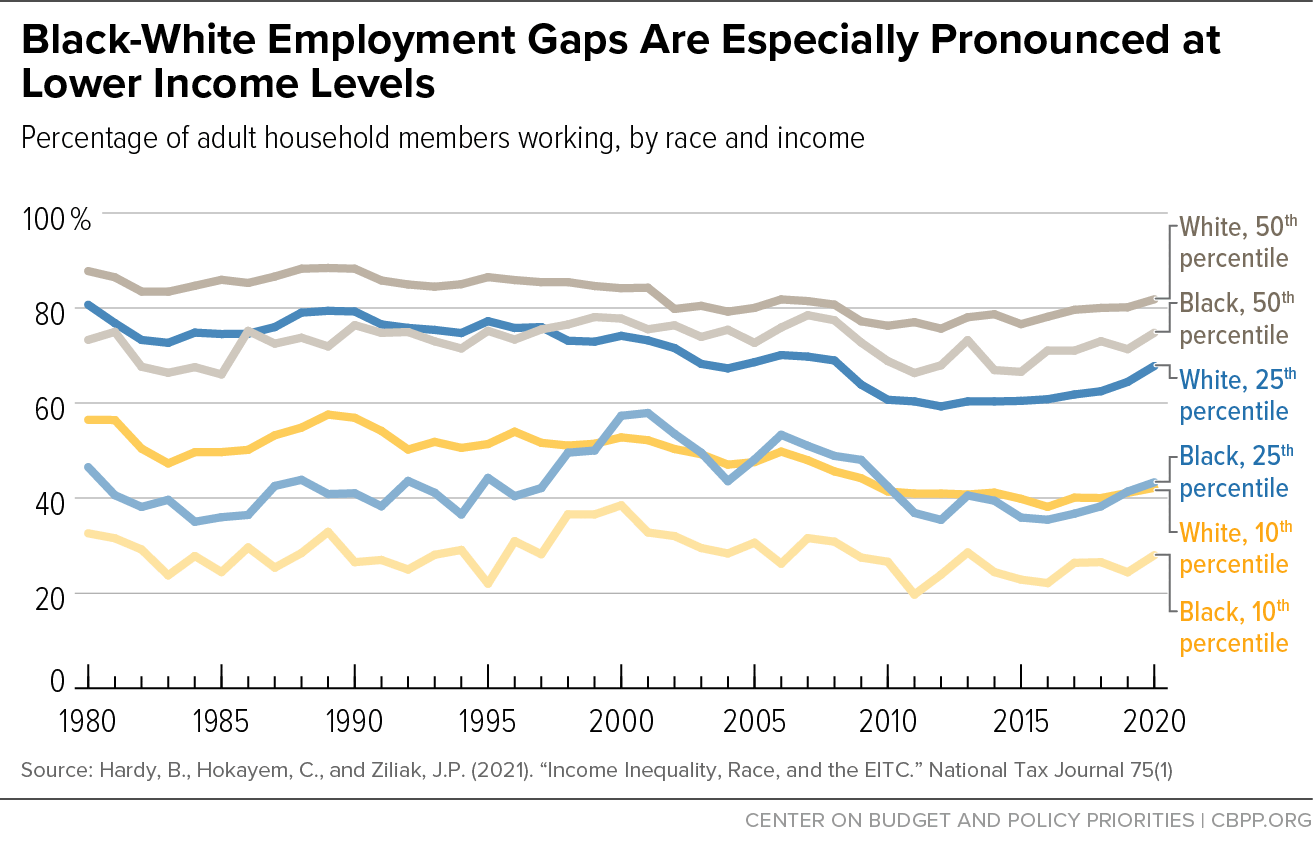

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Summer Jobs And Taxes Part 1 School Aged Children Under 18 2021 Turbotax Canada Tips In 2021 Turbotax Financial Education Tax Refund

Ucp Remove Film Tax Credit Cap They Created Tax Credits Tax Cap

Tax Tips Infographic Tax Time Tax Credits Tax

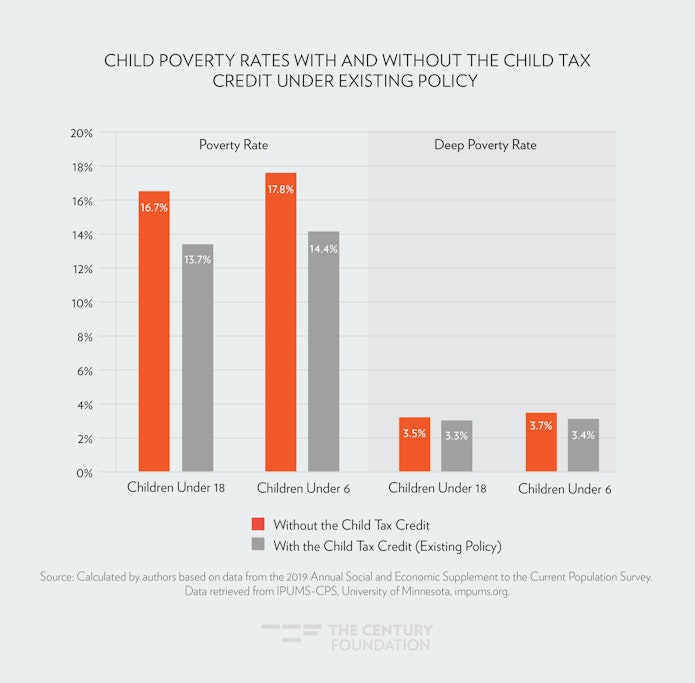

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Canada Child Benefit Ccb Payment Dates Application 2022

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Canada Child Benefit Ccb Payment Dates Application 2022

What Are Marriage Penalties And Bonuses Tax Policy Center

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Canadian Sr Ed Solutions Sr Ed Claim Filing Experts Ed Solutions Credit Solutions Solutions

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

What A Child Allowance Like Canada S Would Do For Child Poverty In America