illinois employer payroll tax calculator

Just enter in the required info below such as wage. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

Employer Payroll Tax Calculator Incfile Com

Also known as paycheck tax or payroll tax these taxes are taken.

. This offers stability and convenience. Withhold 62 of each employees taxable wages until they earn gross pay. That makes it relatively easy to predict the income tax you.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. Newly-created businesses employing units must register with IDES within 30 days of start-up.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. Ad Explore ADP For Payroll Benefits Time Talent HR More. Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

If would like to change your current withholding please complete a new W-4P and send it to the. To contact the Chicago Department of Revenue please. The standard FUTA tax rate is 6 so your max.

An employee can use the calculator to compare net pay with different number of allowances marital status or income. Employers can fill the information in a paystub generator Illinois about their company such as employees information and payment details. Illinois employer payroll tax calculator Sunday February 20 2022 Edit.

Find 10 Best Payroll Services Systems 2022. Use the Illinois paycheck calculators to see the taxes on your paycheck. Then you are probably looking for a fast and accurate solution to calculate your employees pay.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. What Are Employer Unemployment Insurance Contribution Tax Rates.

The department requires all employers and payers to file the following forms electronically. We are trusted by over 900000 businesses provide fast easy payroll options. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for tax year 2022.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion Illinois Individual Income Tax. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. You may pay up to 050 less an hour.

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. This free easy to use payroll calculator will calculate your take home pay. As of January 1 20221 the minimum wage in Illinois is 12100hour.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Online - Employers can register through the. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

Compare the Best Now. Different rates apply to tipped employees and employees under 18 years of age. Our paycheck calculator for employers makes the payroll process a breeze.

Affordable Easy-to-Use Try Now. State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50. Ad Explore ADP For Payroll Benefits Time Talent HR More.

An employer can use the calculator to compute and prepare paychecks. Use SmartAssets paycheck calculator to calculate your take home pay out per paycheck with regard to both salary and hourly jobs following taking into. We are trusted by over 900000 businesses provide fast easy payroll options.

Illinois Paycheck Calculator Smartasset Gnjp7ymet5skum Income Tax Calculator 2020 2021 Estimate.

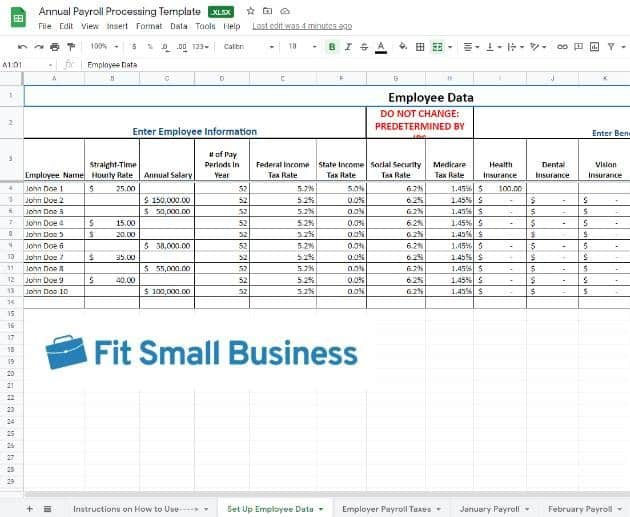

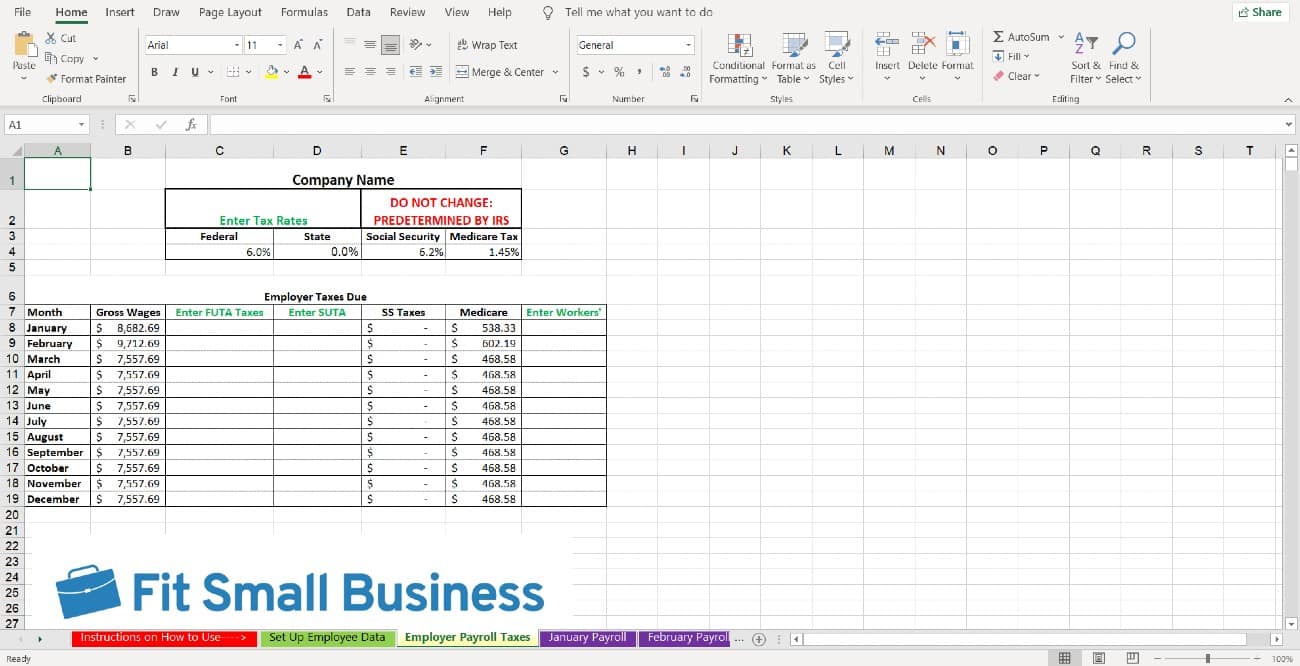

How To Do Payroll In Excel In 7 Steps Free Template

2022 Federal State Payroll Tax Rates For Employers

What Is Form 940 When Do I Need To File A Futa Tax Return Ask Gusto

What Are Employer Taxes And Employee Taxes Gusto

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

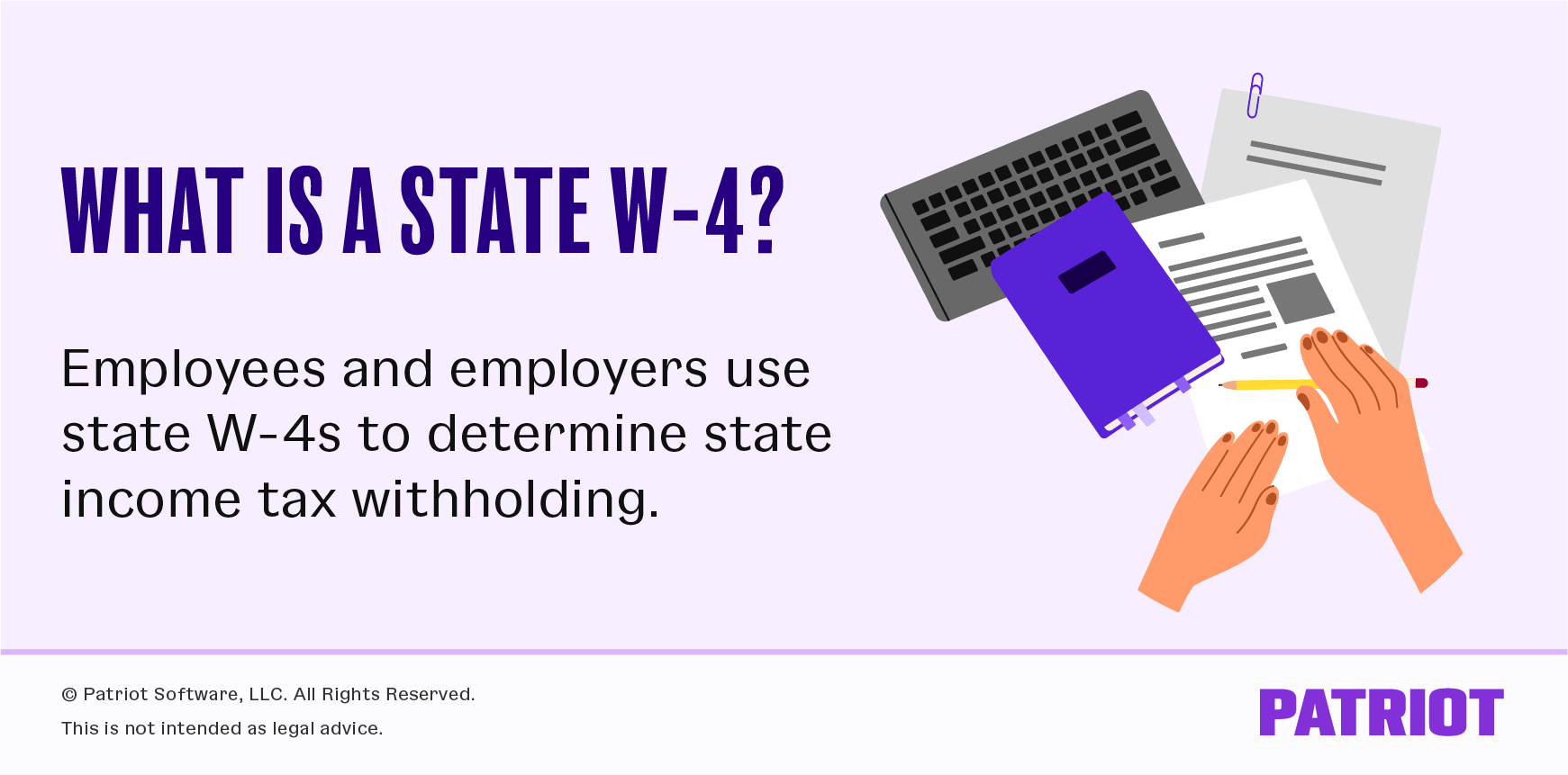

State W 4 Form Detailed Withholding Forms By State Chart

How To Do Payroll In Excel In 7 Steps Free Template

What Are Payroll Taxes An Employer S Guide Wrapbook

Employer Payroll Tax Calculator Incfile Com

What Is The Employer Portion Of Payroll Tax Quora

How To Calculate Payroll Taxes Methods Examples More

What Are Employer Taxes And Employee Taxes Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

How To Calculate Payroll Taxes Methods Examples More

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Salary Paycheck Calculator Calculate Net Income Adp