what is a fit deduction on paycheck

Other groups such as charitable organizations can apply for tax-exempt status. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

Payroll Deduction Authorization Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates Printable Free

This money is a pre-tax payroll deduction meaning that whatever amount you choose to contribute from each paycheck is deducted from your total taxable income Livadary explains.

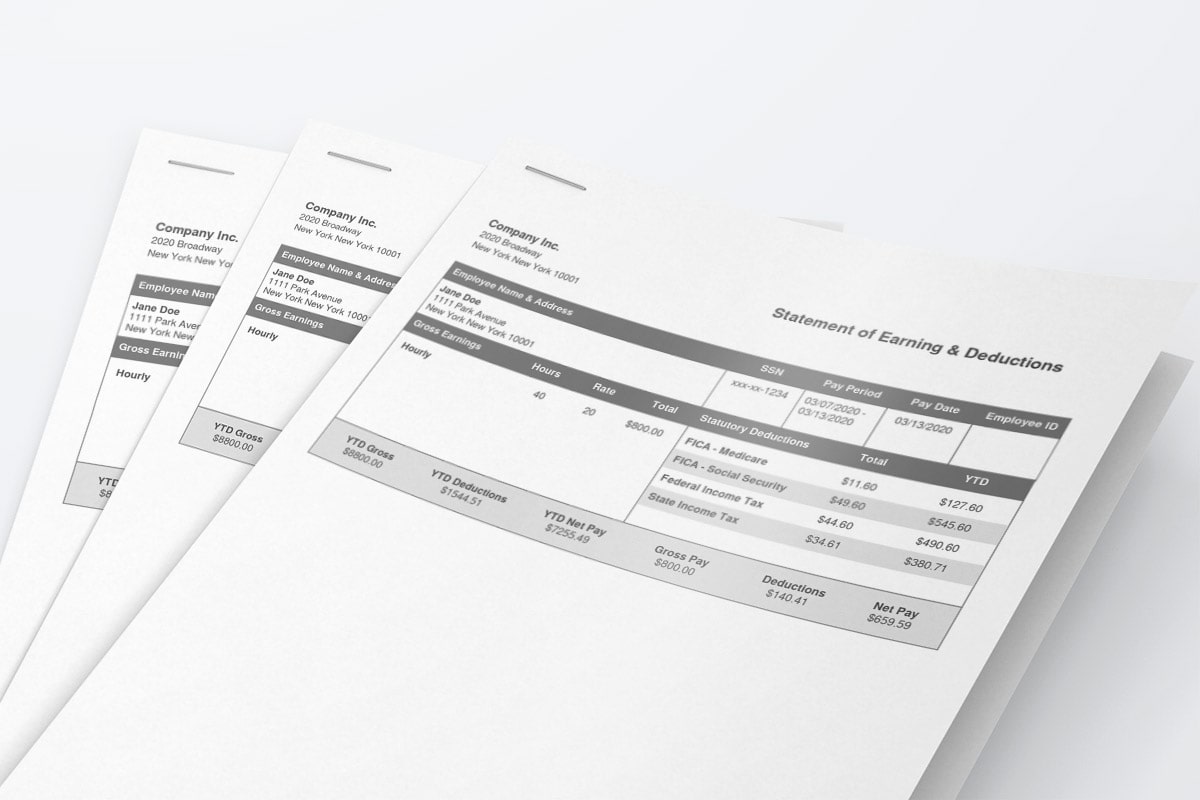

. Some states also have an income. For the Social Security portion of FICA both the employer and the employee pay 62 percent of gross compensation up to the Social Security wage base limit of 147000 totaling 124 percent. Some entities such as corporations and trusts are able to modify their rate through deductions and credits.

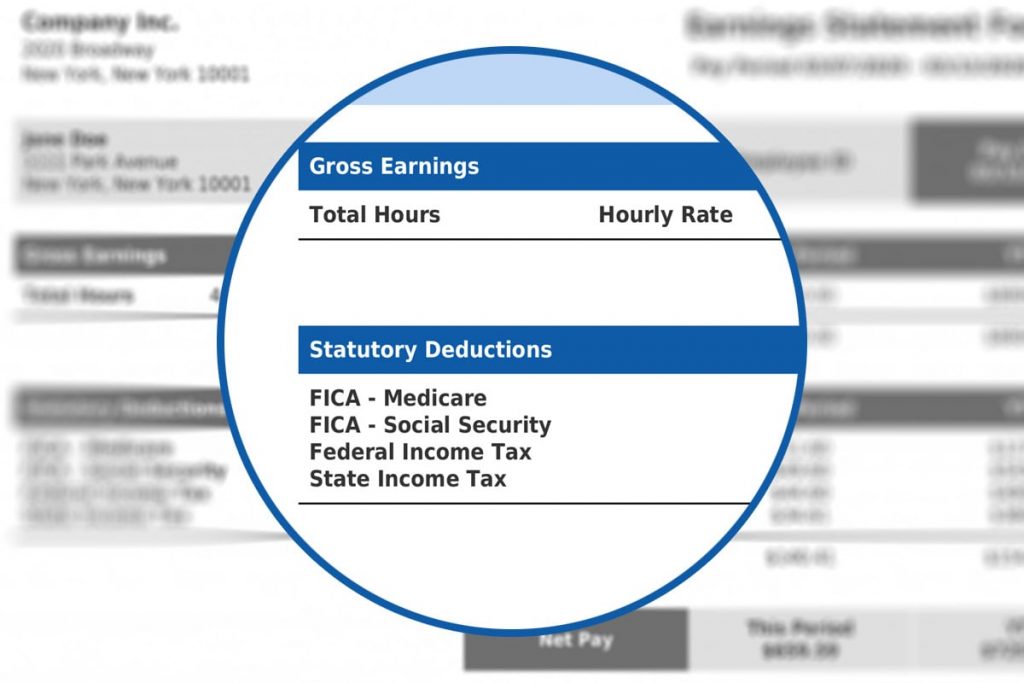

How to Determine Gross Pay. Gross pay is the total amount of pay before any deductions or withholding. These items go on your income tax return as payments against your income tax liability.

1 medicare and 2 social security. Medicare covers medical related costs when you are old and gray. The FIT tax also applies to gambling winnings commissions and vacation pay.

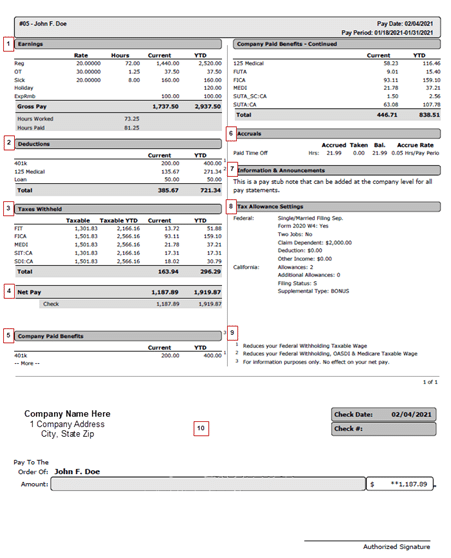

For the purpose of determining income tax and FICA tax for Social Security and Medicare use all wages salaries and tips. Each year the IRS updates the marginal tax brackets so that employers can estimate how much they need to withhold from workers wages. The amount of money you.

They go toward costs needed to run the federal government. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. The rate is not the same for every taxpayer.

If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax. It covers two types of costs when you get to a retirement age. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

FIT is applied to taxpayers for all of their taxable income during the year. Employers withhold or deduct some of their employees pay in order to cover. If youre a business owner you must withhold the federal income tax from your employees salaries bonuses and other earnings.

For salaried employees start with the persons annual amount divided by the number of pay periods. FICA means F ederal I nsurance C ontribution A ct. Payroll taxes and income tax.

Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. Some are income tax withholding. FIT means f ederal i ncome t axes.

FIT deductions are typically one of the. FIT Fed Income Tax SIT State Income Tax. They are all different taxes withheld.

The federal government receiving the FIT taxes will typically use the funds to finance various federal programs and fund various sectors like education transportation energy and other areas. Employers only withhold Social Security taxes up to. So say your salary is 50000 and you contribute 5000 pre-tax over the year to a 401 k youll only be taxed as if you make 45000.

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. These withholdings constitute the difference between gross pay and net pay and may include.

Employee Payroll Form Template Google Docs Word Apple Pages Template Net Payroll Employee Templates

Federal Income Tax Fit Payroll Tax Calculation Youtube

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Pre Tax Vs Post Tax Deductions What Employers Should Know

Wonderfull Home Office Deduction Designing Offices Small Space Office Desk Home Office Designs For Small Spaces Offices Ideas Irs Forms Tax Forms Tax Refund

What Are Pay Stub Deduction Codes Form Pros

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Different Types Of Payroll Deductions Gusto

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

Understanding Your Pay Statement Innovative Business Solutions

Understanding Your Paycheck Credit Com

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

What Are Pay Stub Deduction Codes Form Pros

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Job Description Template Resume Template Checklist Template

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Proposal Templates Templates Business Plan Template